- CAT Courses

- Free Video Resources & Tests

Video Resources

...

- Daily Targets

- CAT Past Papers

- Free Study Material

- BlogsFebruary 14, 2026

CAT Exam With Job: Can You Crack CAT 2026 While Working Full-Time?

February 10, 2026CAT 2025 Preparation Strategy for Working Professionals

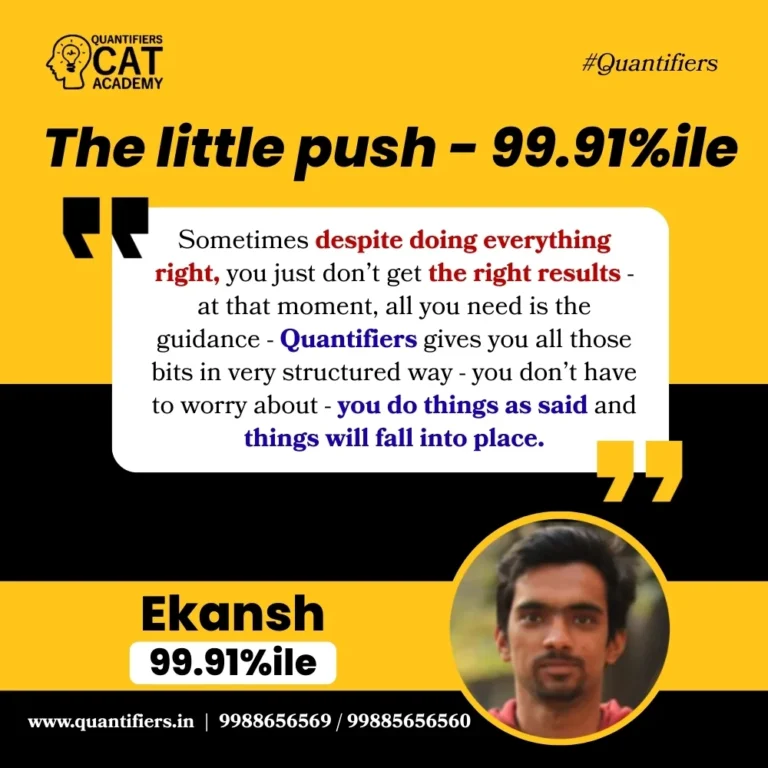

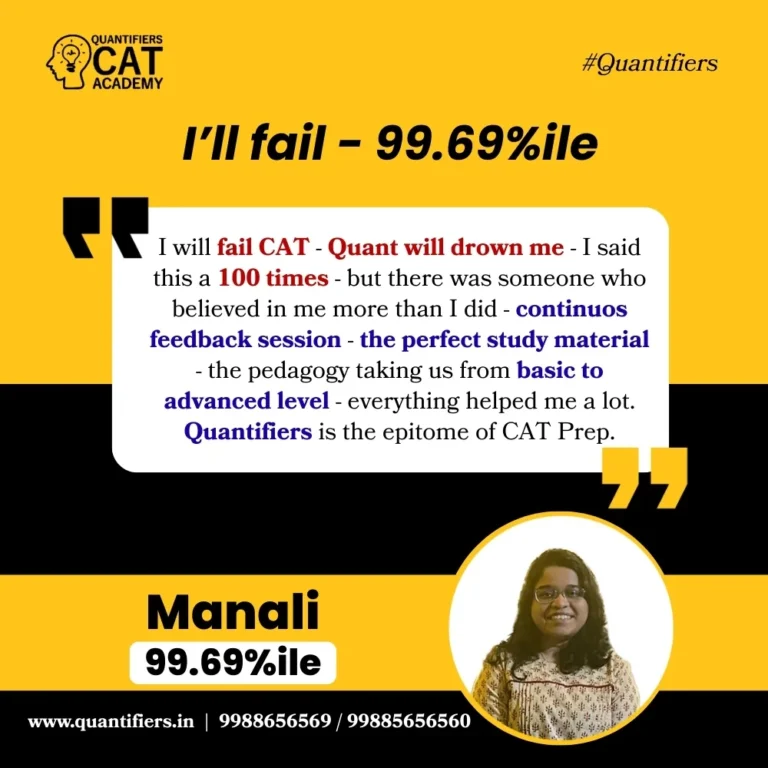

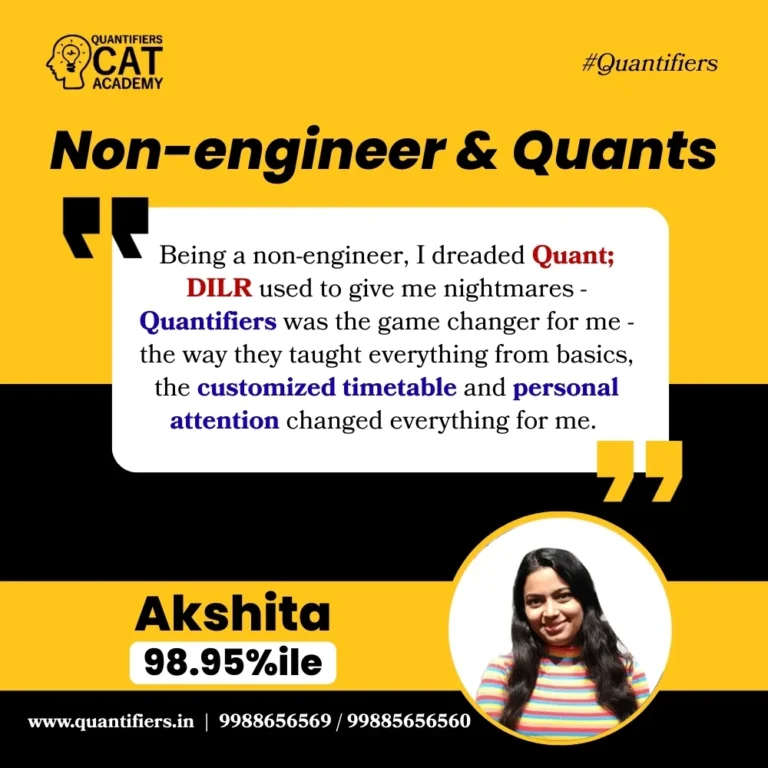

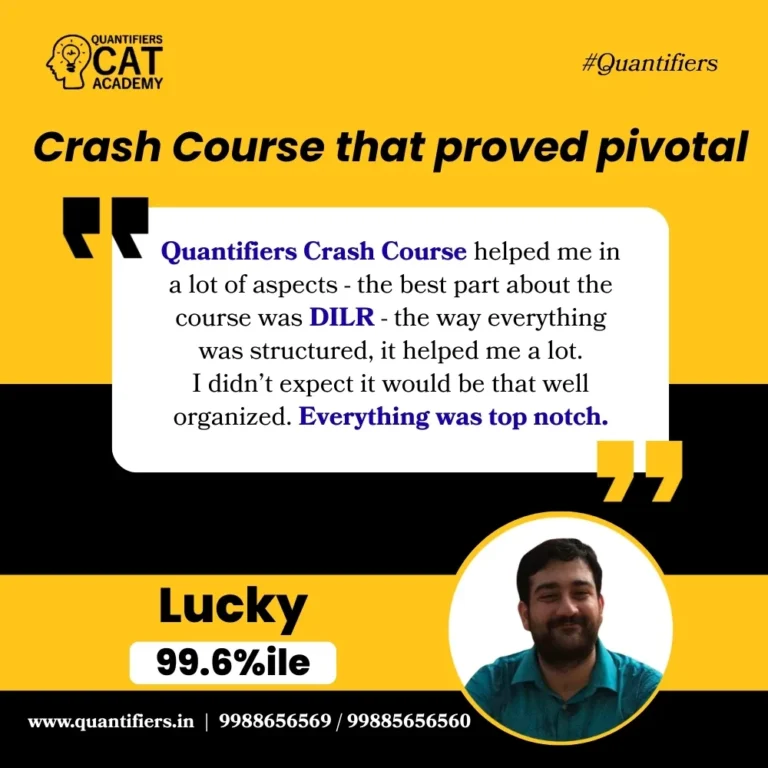

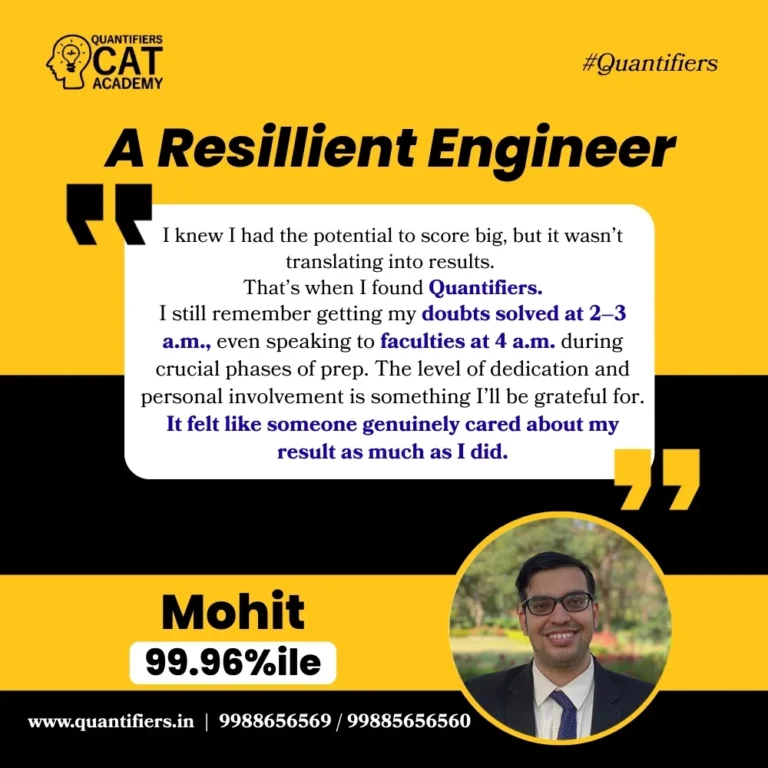

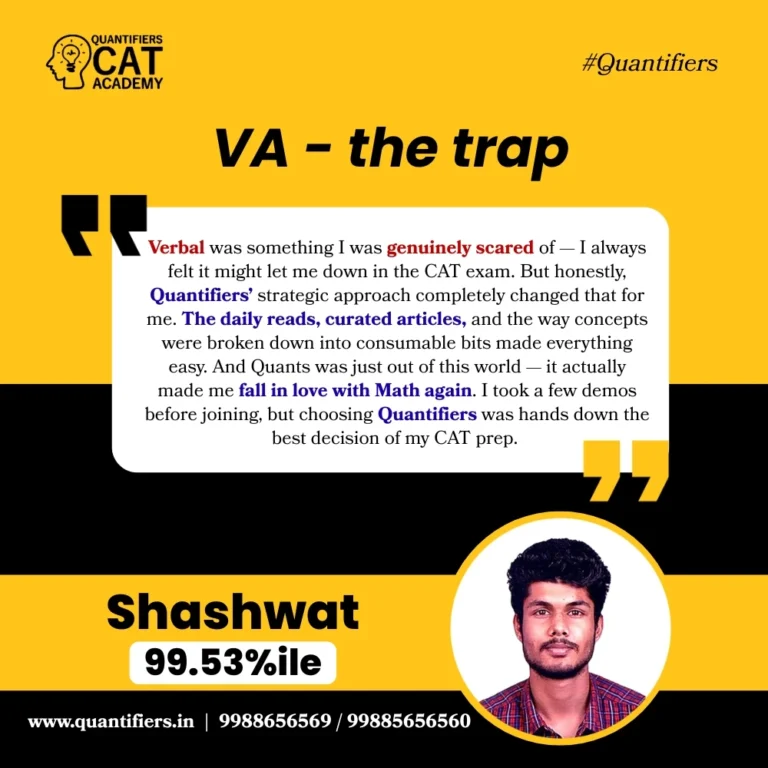

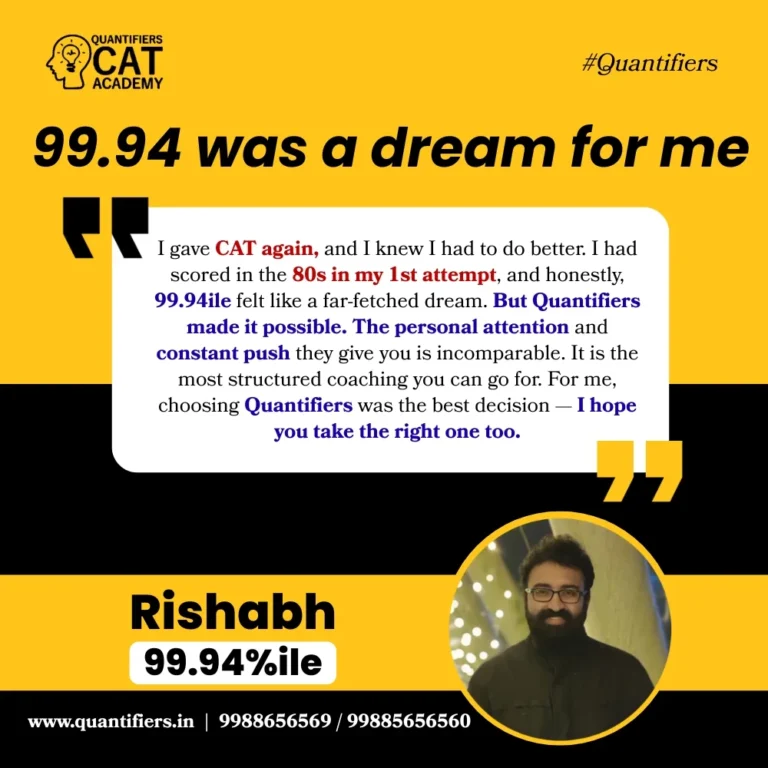

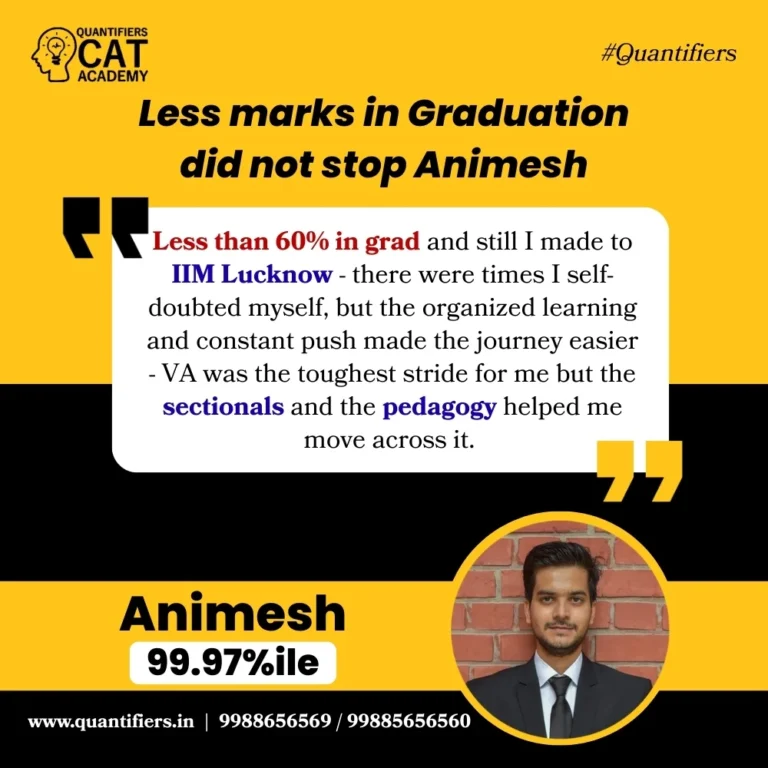

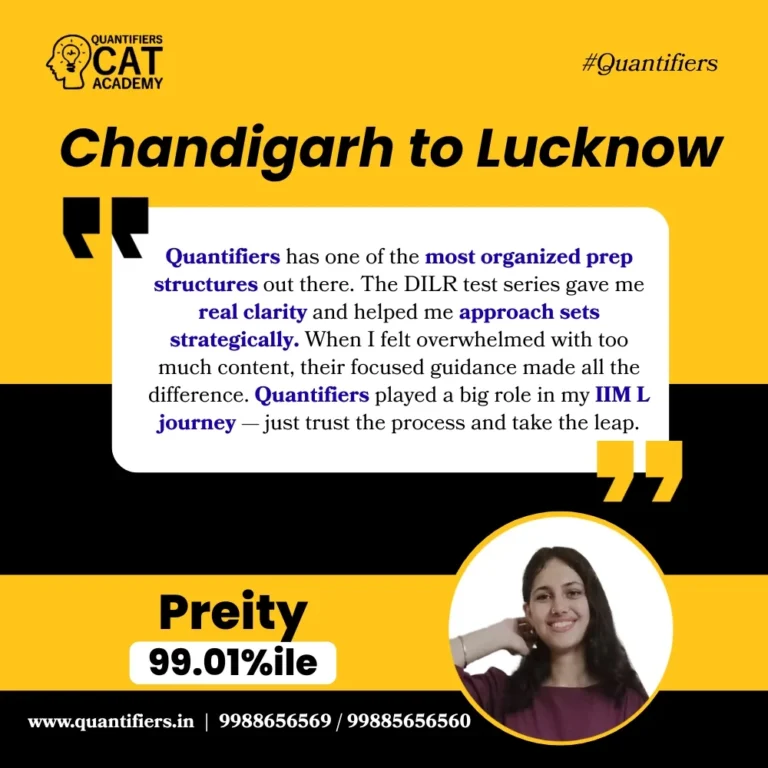

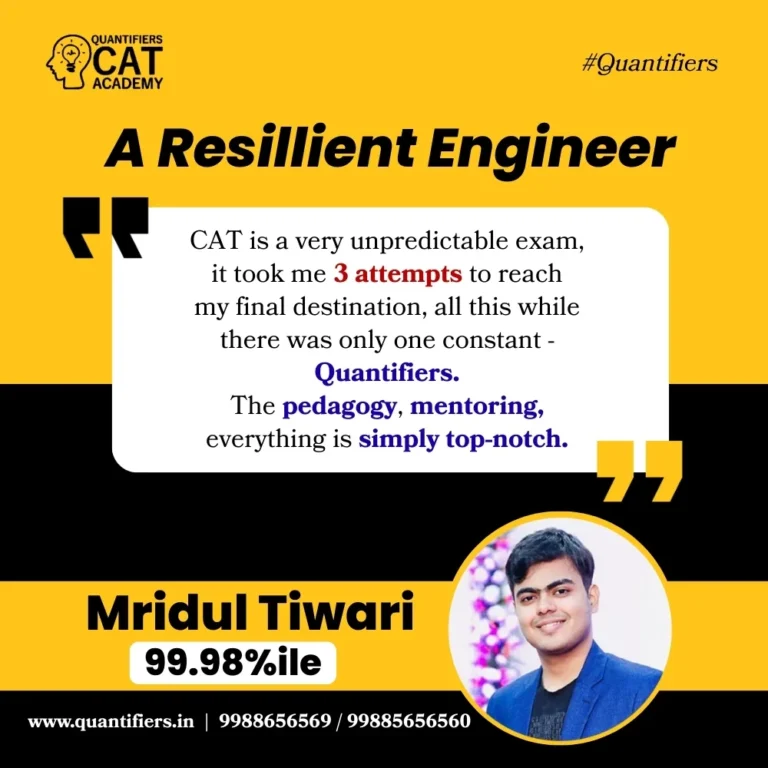

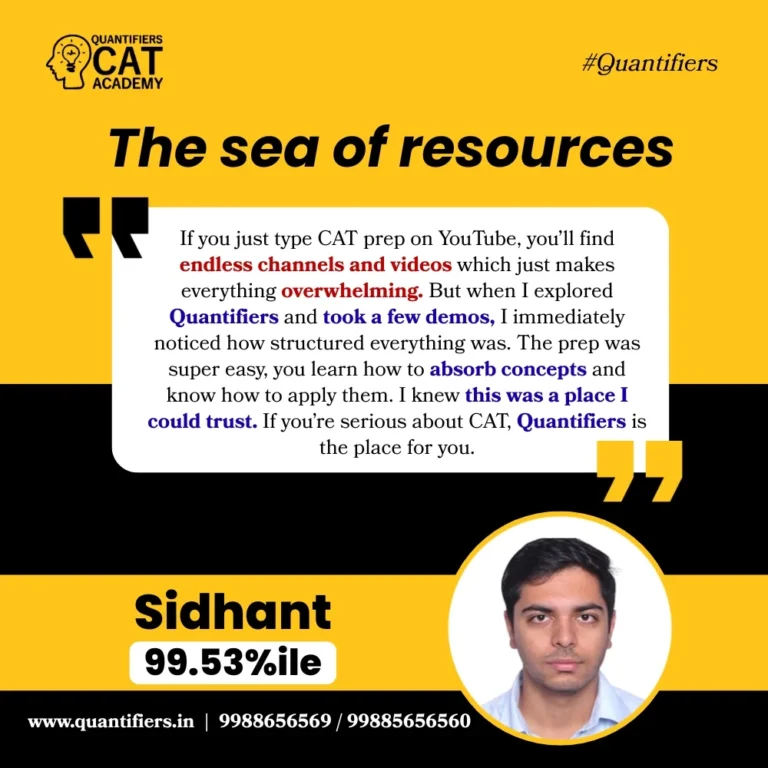

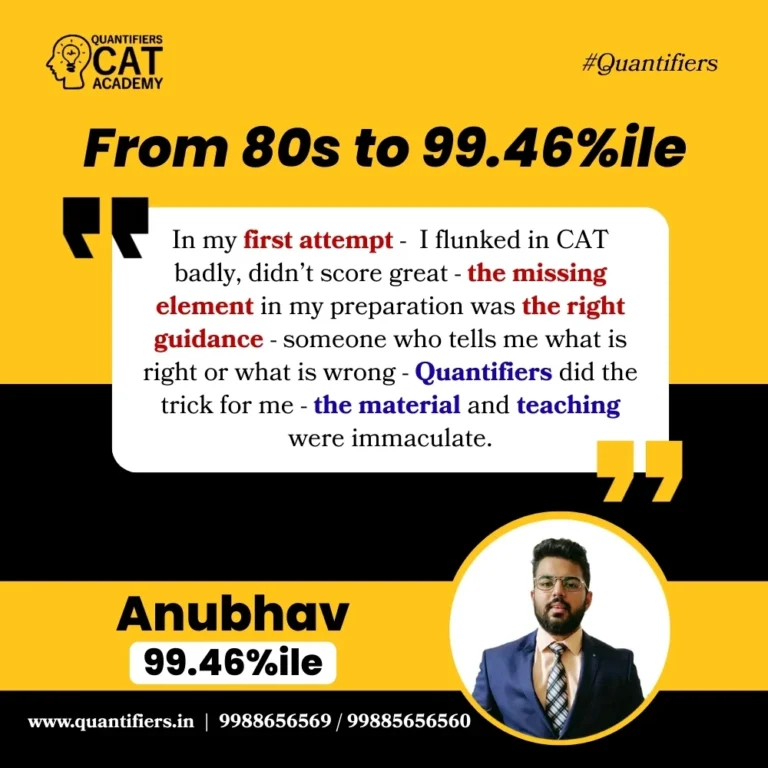

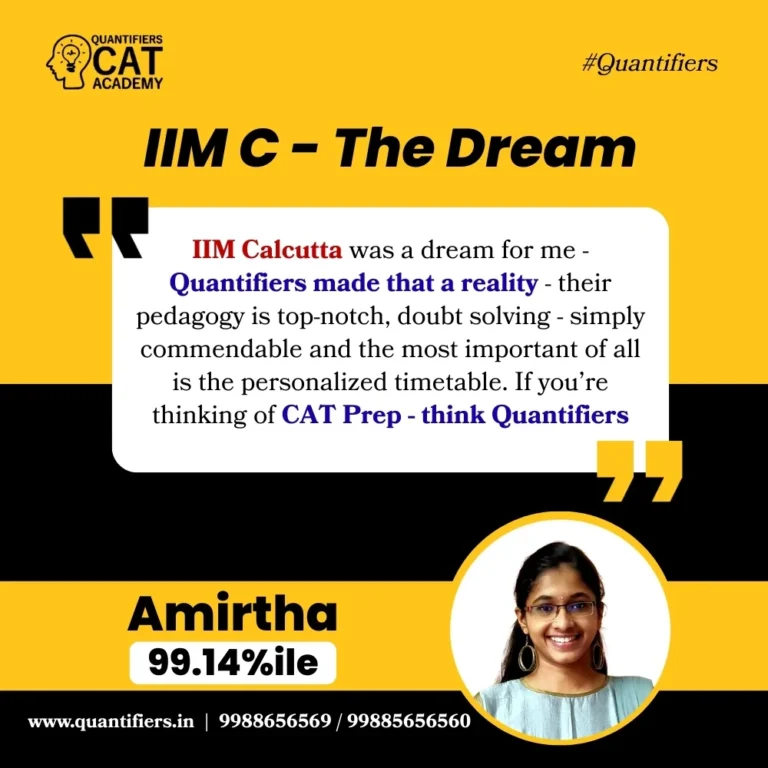

- Results